GST Monthly Return Filing (Up to 100 Invoices) – Efficient Filing for Growing Businesses

Introduction to Monthly GST Filing

If your business generates sales and purchase invoices every month, you’re legally bound to file GSTR-1 and GSTR-3B returns on time. These monthly returns help report your tax liabilities and claim your rightful Input Tax Credit (ITC).

What is GSTR-1?

GSTR-1 is a monthly return that contains details of all outward supplies (sales) made during a month. It ensures your buyers can claim ITC based on your reported invoices.

What is GSTR-3B?

GSTR-3B is a summary return that includes tax liability, ITC claimed, and the net tax payable. It must be filed even if there are no transactions.

Who Needs Monthly GST Return Filing?

Businesses with Moderate Transactions

If your monthly sales range around 50–100 invoices, you fall in the medium-volume business category. This service is tailor-made for you.

Service Providers and Traders

From local shopkeepers to mid-size freelancers or service consultants, monthly GST filing is non-negotiable under GST law.

Why Accurate Monthly Filing is Crucial

Avoid Notices and Penalties

Missing a single filing can trigger GST portal notices and lead to penalties up to ₹5,000 per return.

Ensure Smooth ITC Flow

If your GSTR-1 is inaccurate, your clients won’t be able to claim their ITC, causing disruptions in business relationships.

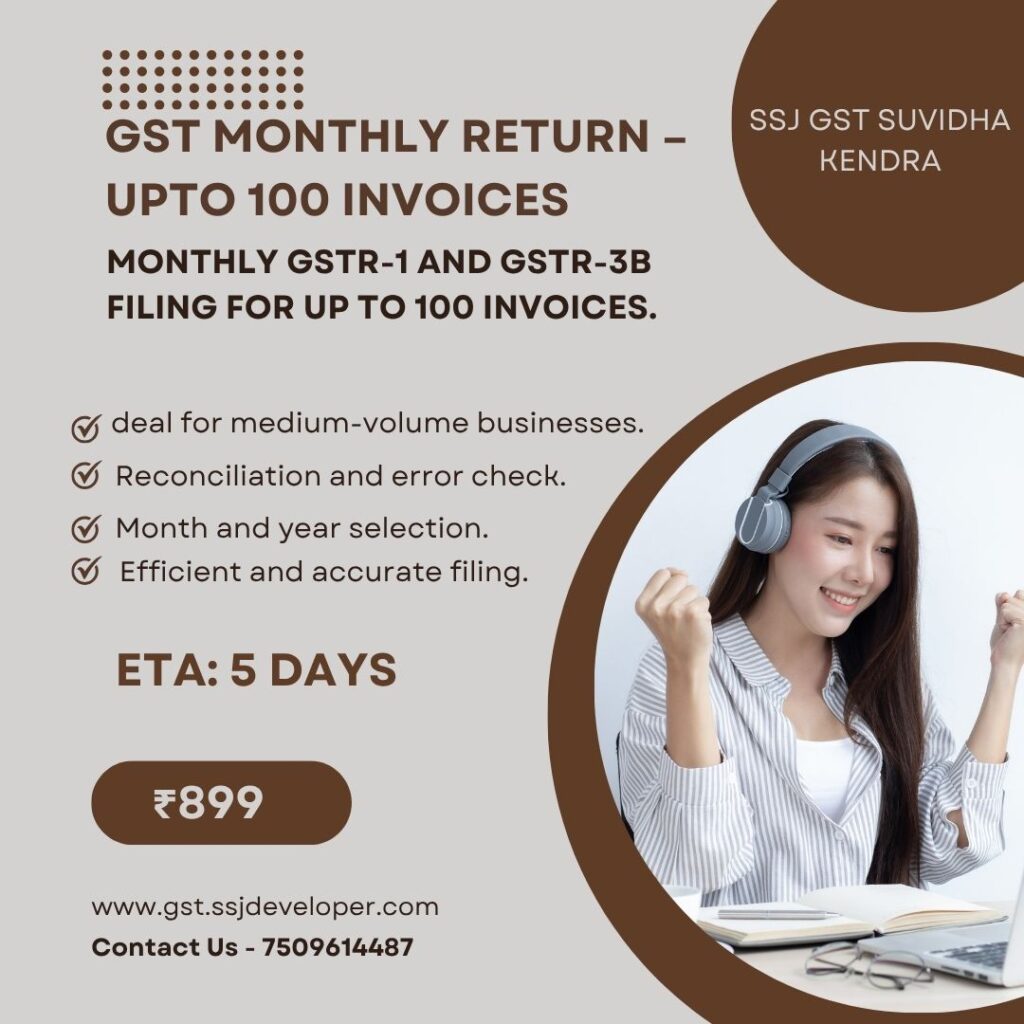

Features of SSJ’s Monthly GST Return Filing Service

- ✅ GSTR-1 + GSTR-3B Filing

- ✅ Covers up to 100 invoices

- ✅ Month & Year selection flexibility

- ✅ Complete reconciliation

- ✅ Expert validation for zero errors

- ✅ All done at ₹899 only

Detailed Process of Monthly Return Filing

1. Collection of Sales & Purchase Data

You simply provide your sales and purchase invoices digitally. We handle the rest.

2. Reconciliation of Invoices

Our experts cross-check for invoice mismatches, duplication, or ITC errors before filing.

3. Filing Returns on GST Portal

Once verified, we file both GSTR-1 and GSTR-3B for your selected month and year on www.gst.gov.in.

Common Challenges in Monthly Filing

Mismatched Invoices

Invoices that don’t match between sellers and buyers lead to blocked credits and audit risks.

Delays and Errors

Filing on the last day can cause technical glitches or interest penalties. Our service avoids that risk.

Importance of Reconciliation

What is Invoice Reconciliation?

It’s the process of matching your purchase and sales records with those uploaded by vendors/customers on the GST portal.

Why It’s Important?

Because even a small mismatch can block your Input Tax Credit or raise compliance flags.

Advantages of Filing Returns with SSJ GST Suvidha Kendra

Expert Team Support

No bots, no guesswork. Real humans with real GST experience guide your filing.

Error-Free & Timely Filing

Everything is reviewed and submitted before the deadline, always.

Budget-Friendly – ₹899 Only

This is all-inclusive pricing, no hidden fees. You get full value for money.

Who Can Benefit from This Service?

Wholesalers & Retailers

Selling dozens of products monthly? This is built for your scale.

Service Businesses

Consultants, agencies, freelancers — your digital invoices are 100% supported.

E-Commerce Sellers

Online sellers on platforms like Flipkart, Meesho, Amazon, etc., benefit from seamless GSTR-1/3B submissions.

Timeline & Turnaround – Just 5 Days

From document collection to final filing, everything is wrapped up within 5 working days—well before the monthly due date.

GSTR-1 vs GSTR-3B – Key Differences

| Feature | GSTR-1 | GSTR-3B |

|---|---|---|

| Purpose | Sales/Outward Supplies | Tax Summary & Payment |

| Filing Type | Invoice-wise | Summary-wise |

| Frequency | Monthly | Monthly |

| ITC Claim | Not Available | Available |

Compliance Benefits of Monthly Return Filing

- 💡 Maintain Good Standing with GSTN

- ✅ Eligible for Loans and Tenders

- 💼 Improve Vendor Trust with Real-Time Invoice Reflections

- 🔒 Avoid Tax Disputes, Notices & Fines

What If You Don’t File Monthly Returns?

Penalties, Late Fees & ITC Blockage

- ₹50 per day (₹25 CGST + ₹25 SGST) as late fees

- Interest @ 18% on unpaid taxes

- GST portal access may be restricted

- Buyer’s ITC may be rejected or withheld

Real-Life Examples: How Monthly Filing Helped Businesses

- A stationery wholesaler avoided ₹10,000+ in penalties through timely monthly filings.

- A design studio claimed 100% ITC through accurate invoice reconciliation.

- An e-commerce seller built trust with clients by reflecting every invoice on GSTR-1.

FAQs on Monthly GST Filing (Up to 100 Invoices)

Q1. Who is this service ideal for?

Businesses generating up to 100 invoices per month, like small shops, agencies, and online sellers.

Q2. Do you file both GSTR-1 and GSTR-3B?

Yes, this plan includes complete monthly compliance.

Q3. Can I choose the month and year?

Absolutely. You select the month/year and we file accordingly.

Q4. How do I send my invoices?

You can upload or email scanned bills or Excel sheets. We’ll take care of the rest.

Q5. What’s the total cost?

Just ₹899 for full filing of both GSTR-1 & GSTR-3B for the selected month.

Conclusion

GST compliance doesn’t have to be stressful. With SSJ GST Suvidha Kendra, your monthly GST return filing is simple, fast, and budget-friendly—especially if you deal with up to 100 invoices per month.

Our team handles everything: reconciliation, error-checking, return filing, and compliance—so you can focus on growing your business. And the best part? You get all of this at just ₹899.

👉 Start your monthly GST filing today at www.gst.ssjdeveloper.com

Leave a Reply